Iridium Finds Its Footing

With the original constellation, Iridium delivered groundbreaking technology in search of a viable business model. In the aftermath of the company’s bankruptcy in 1999, a contract with the U.S. government provided a path forward: developing a partner ecosystem.

This ecosystem — still in place today — empowers partners to develop products and technologies which rely on Iridium’s constellation as a secure, global communications platform.

No Such Thing as a Free Launch

By the mid-2000s, the original constellation had outlived its projected lifespan and the future of the Iridium network depended on a significant upgrade. Unfortunately, this upgrade came with a $3 billion price tag, far larger than the amount available through traditional financing. By 2010, when serious financial talks began, Iridium’s free trailing cash flow was only $135 million. Against the backdrop of the Financial Crisis, the risk versus reward was simply too high to justify this kind of loan from traditional lenders.

To make this financing possible, Iridium’s leadership team worked with the French government to craft a $1.8 billion loan through a consortium of nine French banks led by Société Générale. The French government provided guarantees for the loan as an export credit for Thales Alenia Space. Thales Alenia Space — a joint French-Italian company — served as the primary contractor for the engineering, production, procurement, and integration of the second-generation Iridium constellation.

The structure and details of the financing were as important to its success as the money itself. The loan was structured to be drawn over a seven-year period at an interest rate roughly half that of other loans. Additionally, the duration of the loan continued for seven years after the construction of the satellites for a total tenor of 14 years — ensuring that Iridium could afford the interest that accrued and the principal repayment that followed.

A Game of Risk

At the time, this arrangement was a sizable risk for all parties involved. Multiple issues could have derailed the endeavor entirely. In fact, over the course of the constellation construction, the terms of the loan were renegotiated 4 times as issues caused delays. These renegotiations necessitated Iridium to raise additional capital for the project, culminating in almost $700 million raised through equity and debt offerings between 2012 and 2018.

Beyond the construction of the satellites, other variables also posed risks for the project: the actual launch of the constellation and the profitability of post-launch Iridium. Both issues were solved by doubling down on risk. Iridium partnered with a then-unproven SpaceX for the launch of the new constellation. While a more uncertain option than traditional launch companies, the cost of partnering with the young company was around half that of the next best alternative.

Additionally, the financing arrangement assumed roughly $260 million in proceeds from a hosted payload on the Iridium NEXT constellation. This payload — additional services and technologies launched on the Iridium satellites — were a key part of the vision for the new constellation, providing not only broader technological applications but also ongoing sources of revenue.

Once finalized, the hosted payload of Aireon represented a particularly interesting case study for Iridium. Its space-based ADS-B for tracking flights was selected as the primary payload for the Iridium constellation, despite being little more than an idea at the time. To help get it off the ground, Iridium invested $12.5 million. Aireon went on to raise an additional $340 million in equity capital, becoming an important part of Iridium’s business.

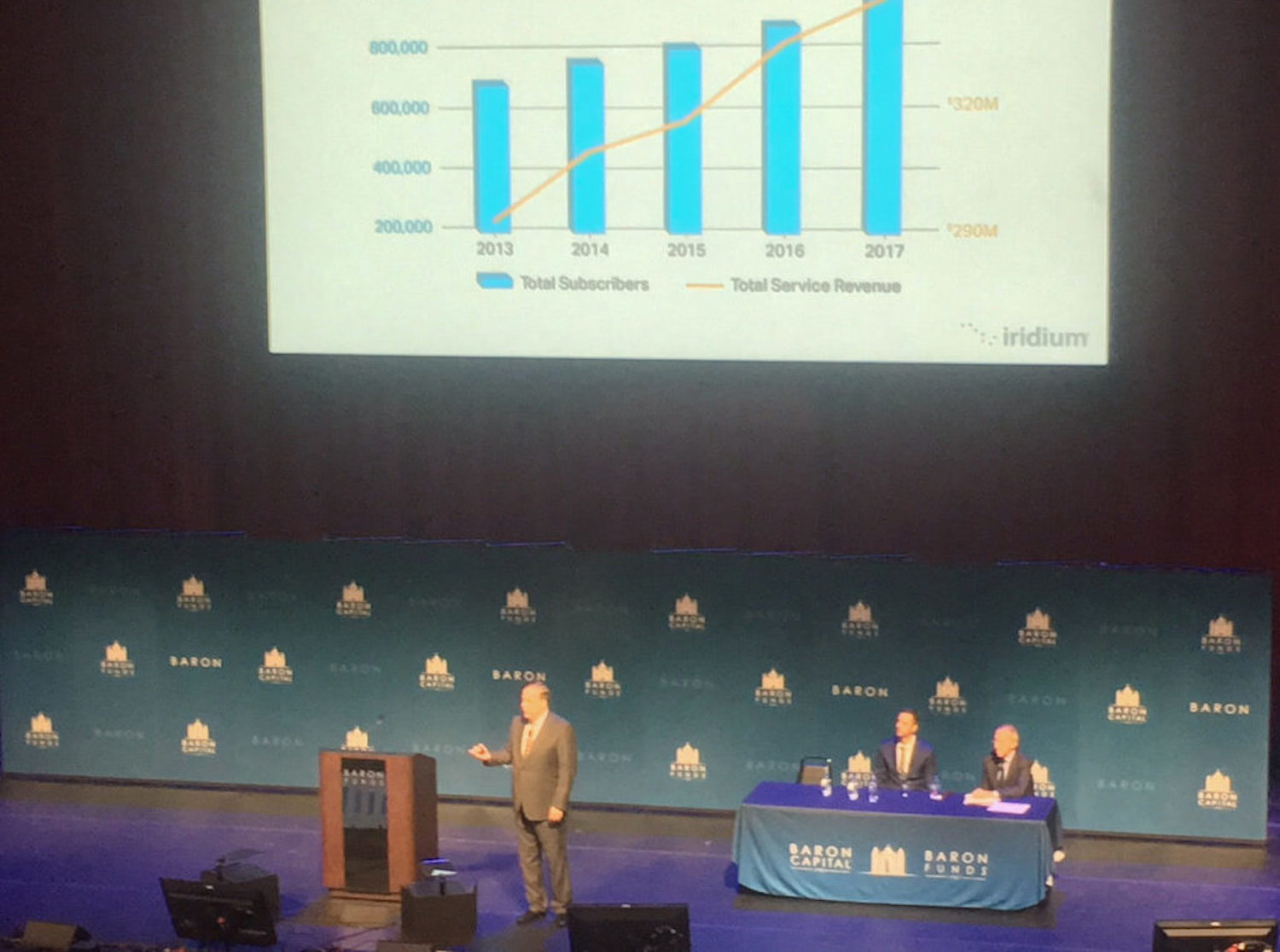

A Modern, Mature Iridium

Today, these loans, risky decisions, and investments are paying off. Through hosted payloads, Iridium has contracts worth $300 million with Aireon and Harris, and the $12.5 million investment in Aireon was valued at approximately $270 million in its most recent equity investment round. These hosted payloads provide a sizable and consistent source of operating revenue and the potential for future dividends from the equity stake in Aireon.

After the successful completion of the new constellation in 2019, the number of partners in Iridium’s ecosystem grew, establishing a broader, more diversified set of companies and organizations paying for its services. This ecosystem provides durable, consistent revenue by ensuring that Iridium doesn’t rely on one company, industry, or sector.

Iridium has reached a new, more mature era both technologically and financially. Moving past the expensive launch of the new constellation, Iridium’s capital expenditures dropped from $435 million over the last three years to roughly $35 million, an annual level that should remain consistent for the next decade. Iridium’s operating profits are projected to continue to grow over the coming years. By 2030, when it will be time to upgrade the constellation again, these profits will be the foundation for a capital program to finance a new constellation, at a lower expected cost than the $3 billion spent on the Iridium NEXT program. Additionally, as Aireon continues to grow, it will be a valuable hosted payload customer for the future.

The markets have begun to properly recognize Iridium’s transformation from a longshot bet to a growing business generating significant cash flow. As Iridium’s partners, revenues, and products continue to grow, there’s only one way for this satellite service provider to go: up.

Beyond the Transformation

As with its technologies, Iridium continues to innovate in business and finance, making smart investments as a part of its commitment to partners, shareholders, and customers. Looking to the future, Iridium’s stable growth is a foundation for continued excellence and endless possibilities.